Coalition argues tax cuts could expand investment in Baltimore

Originally published in NAIOPMD.org

Renew Baltimore – a coalition of economists, real estate professionals, faith-based leaders, former politicians and others – is working to put a tax proposal on the November ballot which they say is key to attracting investment and residents back to Baltimore City.

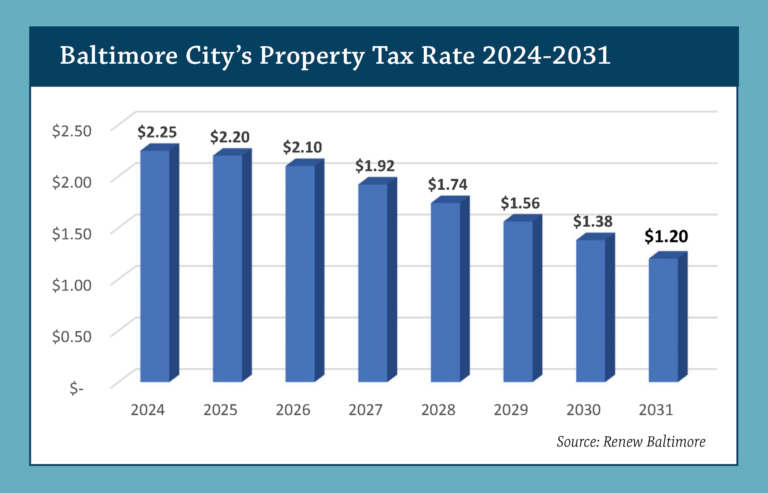

The ballot question would ask voters to support or oppose a city charter amendment that would cap the current property tax rate of $2.25 per $100 of value and then gradually reduce that cap over the next seven years to a maximum of $1.20 in 2031. To qualify for inclusion on the ballot, the group needs 10,000 city voters to sign the charter amendment petition. If adopted, the plan would bring city property tax in line with much lower tax rates in surrounding counties.

The current high tax rate “is the main impediment to Baltimore’s thriving,” said Stephen Walters, Chief Economist with the Maryland Public Policy Institute. “We have been losing population and losing investment for decades. The reason that we lose investment is it doesn’t make much economic sense to invest here when, four or five miles away, you can get a tax environment that is much more favorable. The surrounding county’s property tax rate is less than half of what it is in the city… A necessary condition for a healthy city is you have to have a good investment climate.”

Walters insists that city politicians have known for decades that the high tax rate is a problem. He points to the city’s history of providing Tax Increment Finance packages (TIFs), Payment In Lieu Of Taxes program (PILOTs) and other incentives to attract development as the “best evidence…of a bad tax climate.”

Many supporters of the Renew Baltimore proposal, including several faith-based leaders, insist that practice has created an inequitable tax structure: While some developments receive tax breaks, average residents must shoulder the full cost of the high property tax rate.

Proponents of the tax credit structure argue development projects would not be viable without tax relief in the early years of Renew Baltimore’s plan and that the investments enabled by tax credits quickly generate more tax revenues than the predevelopment uses.

“My church is in Sandtown,” said Derrick DeWitt, Pastor of First Mount Calvary Baptist Church and CFO of a nursing home in the city. “Sandtown is rich in history but poor in everything else. [City politicians] can do amazing things at Harbor East and Port Covington and now they are talking about Inner Harbor. But aren’t you supposed to deal with the whole city?” High property taxes have heightened the barriers to homeownership among lower income city residents, said DeWitt, a supporter of Renew Baltimore.

Furthermore, the combination of high real property tax and even higher taxes on company-owned equipment and supplies (the personal property tax rate of $5.62 per $100 of value) have thwarted efforts to establish small manufacturing facilities or other sources of jobs in distressed areas, like Sandtown.

The Renew Baltimore proposal would address both of those tax problems, said Anirban Basu, Chairman and CEO of Sage Policy Group. The city’s personal property tax rate is limited to 2.5 times its real property tax rate. “If you reduce the real property tax rate, you also reduce the personal property tax rate and that would make the city more appealing to equipment-intensive actors, including manufacturers. As a port city, we should – and could – be home to more manufacturers.”

The Renew Baltimore plan would provide significant financial relief to homeowners, including $175 per month in tax savings on a $200,000 house, said Ben Frederick, Chair of Renew Baltimore and a practicing real estate professional in the city for the past 43 years.

It would also help owners of commercial real estate, including office buildings in the Central Business District, lower their expenses and become more competitive in the midst of a tough market. Lower tax caps could also help stem current devaluations of some commercial properties in the city, Basu said.

“The jurisdictions around us are a lot more competitive with their tax structure,” said Terri Harrington, Managing Principal of Harrington Commercial Real Estate Services, who also serves on the Renew Baltimore Advisory Committee. “As a commercial real estate broker, I would like to see our city, particularly downtown, be able to compete on a level playing field for owners and investors.”

Renew Baltimore supporters also insist the tax plan would spur rapid reinvestment in the city.

“We believe this will trigger an economic boom. There will be scaffolding everywhere,” Basu said. “People want to buy into a growth story. Before we even see major cuts to property tax rates through these caps, you will see massive amounts of investment pour in and lots of property change hands because people want to buy into that long-term trajectory… If we can get this tax change done, Baltimore City’s potential is far greater than almost anyone realizes.”

“Things will turn around immediately,” Walters said. “We have seen property tax caps imposed in other environments that had been tax-unfriendly and investments flooded in immediately because people wanted to get in on the ground floor.”

Frederick points to three examples – Washington, D.C., Boston and San Francisco. Like Baltimore, each city had high tax rates and each had been experiencing substantial population loss since the 1950s. Sharp cuts to tax rates spurred new investments, population gains and growth in total tax revenues within a few years, he said.

“From 1950 to 2000, Washington, D.C. had similar population loss to Baltimore,” Frederick said. “In 1999, Congress passed the Tax Parity Act, which made the city’s rates comparable to surrounding jurisdictions. As soon as taxes became competitive, the population went up. Between 2000 and 2022, Washington, D.C.’s population increased by 12 percent. In the same time period, Baltimore’s population went down 12 percent because we didn’t do tax reform.”

The Renew Baltimore proposal, Frederick added, is also tailored to prevent any interim loss of tax revenue to the city. Property tax rates would drop just five cents in 2025, 10 cents in 2026 and then 18 cents each year for the next five years.

Tax relief would encourage more people to move into the city, Frederick said. “With more people paying into the system, a lower rate can be charged and the city makes the same or more revenue each year.”